SBI Life Insurance Premium Payment Online

Payment of the SBI Life Insurance Premium

Being one of India's major life insurance corporations, SBI Life provides a wide range of insurance policies that meet your financial requirements.

SBI Life provides a variety of customer-centric solutions for education, retirement, family protection, financial security, and asset growth.

SBI Life not only believes in providing its customers with superior insurance products and services to better manage their needs but also in informing its existing and future customers about insurance.

To make it easy for policyholders, SBI Life has established different online and offline platforms for premium payment.

Tell us more about the simple and convenient premium payment options for policyholders. Options For SBI Life Premium Payment Online

Major Advantages of the SBI Life Insurance Online Payment Process

Visiting the Nearest Branch Office, waiting in Long Queues, and providing some documents to pay the SBI Life Insurance Premium is time-consuming.

SBI Life Insurance Company has introduced the Online Payment Service for the client's convenience and to save them time.

Customers can now use the SBI Life Insurance Online Payment Service to pay their insurance premiums online from any location in the world.

As a 24*7 Service, this SBI Life Online Payment feature allows the insured to pay the premium at any time.

SBI Life Insurance Online Payment is a simple, cost-effective, and time-saving process for paying SBI life insurance premiums online.

The following is a list of the advantages of making your life insurance payments online :

1. Fast Service

The online payment process for SBI life insurance is user-friendly, convenient, and quick.

A few steps are required to process the payments. You are not required to wait in line to make a payment.

2. User-Friendly

You can pay your SBI life insurance premium online 24x7 by logging into your account at your convenience.

The company's user-friendly customer portal optimizes and simplifies the premium payment process.

3. Cost-Effectiveness

This service is completely free for registered customers.

Customers can use either the online portal or the SBI mobile app based on their preferences.

There are no hidden or penalty fees associated with the online payment option for SBI life insurance.

4. 24x7 Support

The SBI customer support representative will be easily accessible via the chat box system.

You can even call the SBI's toll-free number for support.

They provide 24x7 support service through their customer support representatives.

Customers of SBI Life can enjoy the convenience of paying premiums without having to walk to the nearest SBI branch office.

The following are some premium payment options for SBI Life customers:

Methods for SBI Life Insurance Online Payment

For all account holders, SBI life insurance online payment delivers quick and convenient customer service.

SBI life insurance policyholders can pay their premiums online and download their premium receipts.

Various platforms, including credit/debit cards, UPI, Bill Pay, digital wallets, and Net Banking, enable online payments.

Here are several online payment options for SBI life insurance via the SBI life customer portal:

1| Internet Banking

Existing customers have access to internet banking services through SBI Life.

You must add SBI Life as your biller to use internet banking services, after which you can enter your policy information.

2| SBI Life Insurance payment by SBI Credit Card

The SBI Life website allows you to pay your insurance premiums online.

SBI Card Pay is a smartphone application that enables SBI Card payments.

By following these step-by-step instructions, any SBI customer can use the service of the SBI card service.

- Download the SBI Card Pay mobile app from the Google Play store on your Android device to get started.

- Launch the SBI Card Pay application and register your SBI card. Bring your phone to the register and make your purchase.

- Visit the website and select from a choice of online premium payment alternatives.

- Include both your policy number and personal details.

- Once your information has been verified, you can select the most convenient payment method and pay.

- This is the quickest method for paying your insurance premiums online.

- You must register an account before you can use visabillpay.com.

- SBI Life should be added to your account as a biller.

- Provide information on the SBI Life policy.

- After verification, you can view and pay your insurance premiums online with a credit card.

3| SBI Life Website Portal

SBI has developed a website that will allow policy holders to pay their premium.

They can also access information regarding the status of their policies as well as several other details regarding the insurance plans in which they have enrolled.

On the official website of SBI, both new and existing users are able to register themselves

- Users must visit the login option on the SBI Life website.

- Register on the website by entering your policy number, date of birth, and mobile phone number.

- Click the "Submit" button to store your information.

- Upon successful registration, you will be able to check the details of registered policies, such as the date of enrollment, amount of premium payable, and bonus that has earned.

- You can use your debit or credit card to pay your premium online.

4| SBI Life Premium Payment by SBI YONO App

The SBI YONO App is a smartphone app that lets you exchange money with other people.

The YONO app lets you do things related to your credit card, like pay your SBI Life Online Premium Payment.

Those who have linked their credit cards to the YONO app can pay with their credit cards by doing the following:

Step 1: Download the YONO app to your phone and sign in with a valid user ID and password.

Step 2: To pay, go to "Credit Cards" and choose the SBI credit card.

Step 3: Next, click "My Relationships" in the drop-down menu to move on.

Step 4: Choose "Pay Now" and click on the button to move on to the next step in the payment process.

Step 5: Choose the type of SBI account from which you want to pay.

Step 6: To finish the process, enter the amount you want to pay and click "Pay Now."

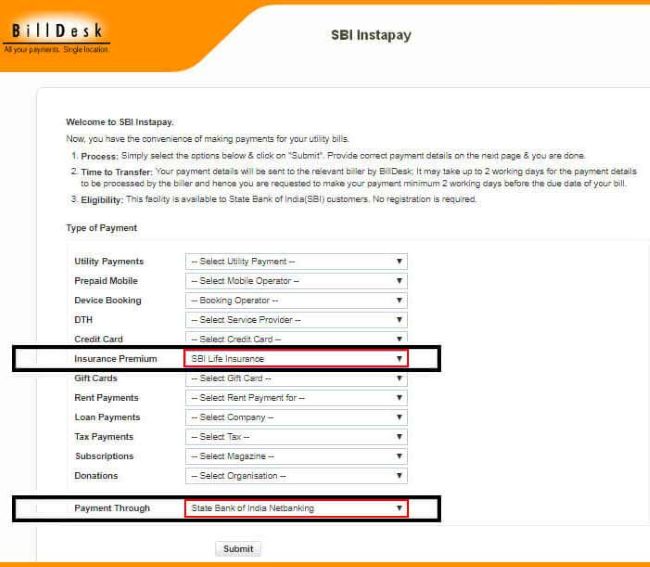

5| SBI Life premium through BillDesk.

- Log in to the BillDesk website.

- Choose SBI Life Insurance from the list of options next to "Insurance Premium."

- In the "Payment Through" option, select "State Bank of India Net Banking" if you are SBI Account Holder.

- Otherwise, choose your bank from the drop-down menu

- Once you click "Submit," you will be redirected to the next page.

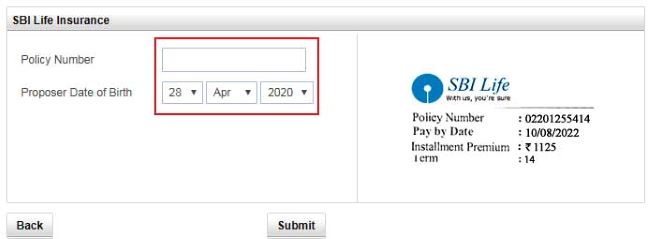

- To move forward, enter your policy number and date of birth.

- After you sign in, you'll be able to see when your premium is due and how much it is.

- You can pay the premium right away or set it up to be paid later.

6| SBI Easy Access App

Follow the steps below to make an online payment for SBI life insurance using the SBI life easy access application on your mobile phone.

- Step 1: Download the SBI life easy-access application on your mobile device

- Step 2: Register yourself and click on the 'Renewal Premium Payment' option

- Step 3: Enter your policy and personal information

- Step 4: Select your preferred way of payment and continue to pay

7| SBI Life Premium through Credit-Card

Using your credit card, you can make an online payment for your SBI life insurance policy by following the instructions below.

Step 1: Register on the visabillpay.com website.

Step 2: In the biller box, enter SBI Life as your biller.

Step 3: Enter insurance details and verify.

Step 4: Submit your payment.

Step 5: Pay your SBI life insurance premium online with a credit card.

8| Through the Jio Money App

- Download the Jio Money app from the Google Play Store to your smartphone.

- For iPhone download Jio Money app from Apple Store

- In the 'Recharge and Bill Pay' section, select the 'Bill Pay' option.

- Choose SBI Life Insurance as your biller from the 'Insurance' tab.

- You will need to enter your policy number as well as your date of birth.

- To complete transaction use Jio Money wallet or Jio Money UPI.

9| SBI Life Premiums Payment using SBI ATM

Use State Bank of India (SBI) ATMs to make insurance premium payments. Follow the steps mentioned below to pay SBI Life Premium.

- Insert your card into the ATM machine of any State Bank of India ATM.

- Enter your SBI ATM Card password.

- Click on "Services" and then 'Bill Pay."

- Choose "SBI Life Insurance" from the given list of options.

- Fill in your SBI Life policy number and date of birth.

- Press "Confirm" and make your SBI Life Insurance premium payment.

10| Point-of-Sale Terminals in SBI Branches

Point-of-sale terminals at SBI Life branch offices are another option for convenient premium payment.

At some SBI Life branches, you can use your debit or credit card at the point of sale terminals to pay your premiums.

11| Offline Premium Payment Methods

In addition to paying online, SBI Life policyholders can also pay for premiums in a number of convenient ways offline, such as by direct debit or check.

The following are offline premium payment options for SBI Life policyholders.

a) By Courier or Mail

Send a demand draft or a check for the payment of your premium to your local branch office.

As confirmation of your payment, a receipt will be emailed to your address of communication.

b) Auto-debit Through NACH

The National Automated Clearing House (NACH) allows SBI Life policyholders to pay their premiums through its auto-debit service.

To activate the auto-debit feature, you must submit a properly completed mandate form and a bank statement or canceled check as evidence of your bank account.

You can mail your documents to the following address:

SBI Life Insurance Company Limited,

Central Processing Centre,

8th Floor, Seawoods Grand Central,

Tower- 2, Plot No.- R-1, Sector- 40,

Seawoods, Nerul Node,

Navi Mumbai - 400706, Maharashtra, India

c) Direct Transfer at the SBI Life Branch

To make a direct deposit at an SBI Life Branch office, mail (by post) a Demand Draft (D.D.), Cheque or Money Order (M.O.) to the address of the nearest SBI Life Branch office.

Your policy number and phone number must be written on the back side of the Demand Draft, Cheque or Money Order.

d) Cash Payments at Authorized CSCs.

At authorized cash collection centres, SBI Life premiums can be paid in cash. Here is how to proceed:

Cash payments of up to ₹ 49,999 can be accepted for the premiums at Common Service Centres (CSCs).

You may pay a premium of up to ₹ 50,000 via direct debit at any Karur Vysya Bank branch.

If you reside in Andhra Pradesh or Madhya Pradesh, you can use AP Online or MP Online to pay up to ₹ 50,000 in SBI life insurance premiums.

FAQ : SBI Life Online Premium Payment

At the SBI ATM, you must insert your card and select 'Services' from the available options.

Select SBI Life Insurance from the Bill Pay menu option.

You must enter your policy number and date of birth to make a payment.

The auto-debit service is available to people with accounts at SBI, Axis Bank, Kotak Bank, Punjab National Bank, Union Bank of India, ICICI Bank, CITI Bank, Bank of Baroda, Indusind Bank, and Bank of India.

In order to benefit from the auto-debit feature, policyholders must submit a completed Mandate Form and a cancelled cheque at their local SBI bank.

Premiums for SBI Life insurance policies can be paid at the Common Service Centres (CSCs). CSCs accept up to ₹ 49,999 in cash for premium payments.

SBI Life has also designated Karur Vysya Bank branches as collection centres where you can deposit up to ₹ 50,000 in premium.

Selected SBI branches provide the facility to pay premiums through Point of Sale terminals.

Policyholders can easily pay their SBI Life premiums using Debit and Credit Cards at Point of Sale Terminals.

For questions, comments, and recommendations, you can email the customer service representatives at info@sbilife.co.in or call the toll-free Number 1800 22 9090.