What is Income tax return

The Income Tax Return (ITR) is a form that should be submitted to the Income Tax Department of India.

It comprises information on a person's income and the taxes that must be paid on that income throughout the year.

The information in an ITR must be for a specified financial year, which begins on April 1st and ends on March 31st of the next year.

- Income can come in a variety of sources, including:

- Income earned from Salary;

- income and gains from any type of business and profession;

- income from rental properties;

- capital gains income; and

- income from some other sources, like interest on deposits, dividends, royalties, lottery winnings, and so on.

form What is e filing

Today, filing an income tax return online is very simple and easy, allowing you to do it yourself rather than depending on a tax professional.

Filing an income tax return is a legal requirement for everyone. Individuals under the age of 60 whose gross total income before deductions does not exceed ₹ 2.5 lakhs, on the other hand, do not need to file.

This ceiling is ₹ 3 lakh for resident senior persons (aged 60 to 80 years) and ₹ 5 lakh for resident super senior seniors (aged above 80). The steps for filing an income tax return online are as follows:

Income Tax Return Forms

The form ITR-1, form ITR-2, form ITR-3, form ITR-4, form ITR-5, form ITR-6, and form ITR-7 are the seven types of ITR forms used by the Income Tax Department of India.

Who is applicable for which form is specified and decided by the nature and type of income as well as the type of taxpayer.

The following is a list of the most regularly used ITR forms:

ITR Forms | Class of Taxpayer |

ITR Form 1 | Salaried Individuals |

ITR Form 2 | Hindu Undivided Families (HUFs) and any individuals with income from other sources except business and profession |

ITR Form 3 | HUFs category with main income from business or profession |

ITR Form 4 | HUFs and Individuals with main income from house property |

ITR Form 4S | Comes under a special tax liability scheme for HUFs u/s 44AD/AE |

ITR Form 5 | Artificial judiciary entities, AOPs, Firms, LLPs, and local authorities |

ITR Form 6 | Companies that do not claim exemptions u/s 11 of the IT Act. |

ITR Form 7 | Individuals falling u/s 139(4D), 139(4B), 139(4C) |

Nowadays, completing an income tax return online is very simple and easy, allowing you to do it yourself rather than depending on a tax professional.

Filing an income tax return is a mandatory requirement for everyone. Individuals under the age of 60 whose gross total income before deductions does not exceed ₹ 2.50 lakhs, on the other hand, do not have to file.

This limit is ₹ 3 lakh for resident senior citizens (aged 60 to 80 years) and ₹ 5.00 lakh for resident super senior citizens (aged above 80). The steps for filing an income tax return online are as follows:

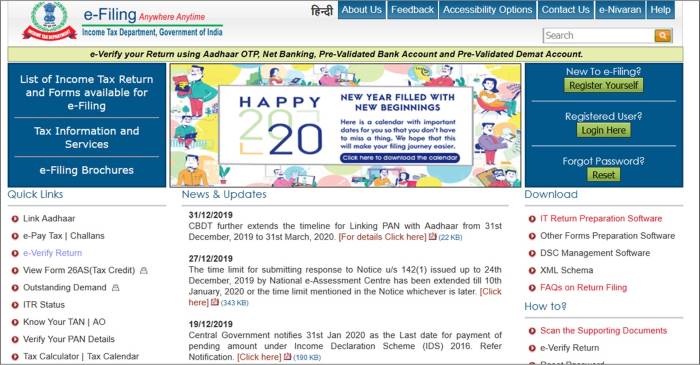

- Go to https://www.incometaxindiaefiling.gov.in/home to open the Income Tax e-filing website.

- Download the Excel programme. Click on “IT Return Preparation Software” in the “Download” section.

- Based on the nature of income stated in the description box, select the most appropriate ITR Form and download it in Microsoft Excel format.

- Create an account and log in to the income tax portal.

If you're a first-time visitor, select "Register Yourself."

(To register, choose a user type, fill in the relevant information, and confirm your registration.)

If you are an earlier registered user, directly log in by clicking “Login Here”.

• Download and Save the XML file on your computer.

Once you've logged in, Click on "My Account" and select "Download Pre-filled XML." Select the A.Y. (Assessment Year) for which you have to file the return.

Step 2: Select the ITR Form Number for which the excel utility was downloaded.

• Use the Excel tool to import data

The Excel and XML utilities will be downloaded in the desktop or laptop downloads folder.

Click on "Import from XML," and open the excel utility, you have already filled details in an XML file. Import the filled data which was a pre-filled downloaded XML file.

• Creating an XML file

Go through the auto-filled information and enter the data in the space provided in the excel utility. Once you've entered all of the required info, then click on "calculate tax."

If you are liable to pay taxes, then go to the "Taxes Paid and Verification" tab and click "e-pay Tax."

The NSDL website will be redirected to you. Choose the correct options and pay the taxes. Then it will generate a challan.

Under the “TDS” tab> “Serial No. 21 IT – All details of Advance Tax and Self-Assessment Tax payments,” enter your challan details in the excel utility form.

In each sheet, click the "Validate" button, then "Generate XML file."

There will be a summary tab with the option to "save XML."

Why should you file ITR?

If any of the following conditions apply to you, filing an income tax return (ITR) in India is necessary:

- If your total annual income is more than the basic exemption limit, check the table below :

Particulars | Amount |

Individuals age is below 60 years | ₹ 2.5 Lakh |

Individuals whose age is above 60 years but below 80 years | ₹ 3.0 Lakh |

Individuals age is above 80 years | ₹ 5.0 Lakh |

- If you want a refund from the Income Tax Department.

- If you earned or invested in foreign assets throughout the financial year.

- If you have future plan to apply for a visa or a loan.

- If the taxpayer is a firm or a partnership, running in profit or loss.

Also, even if your income is below the basic exemption amount, you must file an ITR if you fulfill one of the following conditions:

- Have deposited a total of more than ₹ 1 crore in one or more current bank accounts; or

- Have spent more than ₹ 2 lakh on international travel for yourself or another person; or

- Have spent more than ₹ 1 lakh on power consumption.

Important documents to help you in preparing your ITR

Apart from your salary slips, bank savings account passbook, Aadhar card, and PAN card, there are a few more documents that you will need when you take a seat to continue the process of filing your income tax return:

Form 16:

This form is issued by your company and includes information about your salary as well as the tax deducted at source (TDS) on it.

Form 16A:

This form contains information on the TDS deducted on interest received from fixed or recurring bank deposits.

Form 16B:

When you sell a property, TDS is levied to the sum received from you by the buyer, which is detailed in this form.

Form 16C:

This form records the TDS information of the rent paid to you by your tenant.

Form 26AS:

This form is your entire tax statement based on your PAN number. TDS by your employer, bank, or any other organization that has made a payment to you is included in this category.

Advance taxes or self-assessment taxes paid, as well as proof of tax-saving investments such as deductions as stipulated by Sections 80C to 80U, such as a life insurance policy or a term plan, are all listed.

Electronically filing your ITR

If you have internet access, you may now file your tax return from the comfort of your own home.

This has been made possible by the Income Tax Department's e-filing system, which uses pre-approved tax preparation software.

Because of the advantages of submitting taxes online, an increasing number of taxpayers are doing so.

Refunds:

If tax was deducted at source on a payment given to you and you want a refund, you must file your ITR for the financial year in order for your refund to be processed.

Verification proof:

When you apply for a loan, your eligibility is calculated based on your annual income.

An ITR form with information of your income provides the borrower with a clear overview of your previous earnings, giving your application more credibility.

Similarly, visa applications demand proof of income, with tax returns being the most commonly acceptable document.

Proof of income:

If you buy a term plan, your insurer may ask for your ITR to evaluate the compensation that will be paid to your beneficiaries in the case of your death or disability.

For this purpose, the ITR is regarded as an officially verifiable proof of income.

ITR (Income Tax Return) forms are used by taxpayers.

After learning everything there is to understand about what is an income tax return, keep in mind that there is no one-size-fits-all ITR form.

Depending on the type of money earned, the Income Tax Department provides different forms for each taxpayer:

Checking the status of your ITR online

After you've filed your tax return, you may easily check its status on the Government of India's e-filing website.

Here are a few simple steps to check your ITR status, depending on whether or not you have created a login account on the website:

Without a username and password:

On the left side of the website, click the ITR status link. You will be sent to a page where you must enter your PAN number, ITR acknowledgement number, and captcha code. Once you've entered your info, your tax filing status will display.

Login information:

Use your username and password to access the site. Then select the option to "see returns or forms."

From the dropdown menu, select the assessment year and income tax returns. You can then check to see if your ITR has been validated or processed.

Income tax return download

The Income Tax Department provides a verification form once you have properly filed your tax return, allowing you to verify the e-filing of your taxes done online.

Only those who file their taxes without a digital signature are permitted to do so. Let's have a look at how to get the ITR V form on the website.

- Go to efiling Portal or Click here to to access the Income Tax Department of India's website.

- To view your e-filed return, go to 'View Returns/ Forms.'

- Then, from the list of options, choose income tax returns.

- This will show you all of the returns you've submitted for all the other years.

- Download ITR V by selecting 'ITR-V Acknowledgment' from the acknowledgement number.

- To open the document, enter your PAN number in lower case and your date of birth when asked for a password.

Take a print of the document and sign it. Within 120 days of e-filing your tax return, send it to CPC Bangalore by mail.

The other option is to generate an Aadhar OTP and complete e-verification of your ITR via net-banking, ATMs, or other methods.

The Importance of ITR Filing

It is your responsibility as an Indian citizen to file your income tax. It also helps the government in serving the needs of its residents.

Even though filing an ITR is optional, here are some reasons why you should:

- It is a symbol of duty to pay tax on your annual income to the government on time, according to the standards established by the Income Tax Department.

- You could face a penalty if you don't do so. It's easier to make financial transactions if you've been paying taxes on your income on a regular basis.

- Volunteering and filing your ITR, even if it is not required, might benefit you in a number of ways. Consider registering an immovable property in a state that requires verification of income tax returns for the previous three years.

- If you plan to apply for a loan or a credit card in the future, having an ITR record could help you. If you're looking for a home loan as a co-borrower, it's a good idea to have your spouse's ITR data as well.

- Before beginning a transaction, credit card companies and other financial companies prefer to view your last year's returns.

- Even if your income is below the limit for filing an ITR, you may be able to claim an adjustment for any loss you or your business suffers in the short or long term if you do so.

- It includes a number of losses that aren't specified in the ITR for a given financial year and for which no future exemption may be claimed.

- If you haven't filed an original return, you don't have the legal option of filing a revised return. If you have to file a revised return under any circumstances, this can be a negative.

Benefits of submitting an ITR online

Now that you know what an income tax return is, let's look at the advantages of e-filing that make it the preferred method for the large number of taxpayers. Here are a few examples:

- In comparison to offline returns, not only is your ITR acknowledged fast, but refunds for e-filing are also processed quickly.

- Due to the built-in validations of the e-filing software, there are fewer risks of error while paying your return online. E-filing is a superior alternative because of this, as well as the seamless online interaction.

- You can submit your ITR at any time of day or night, from the comfort of your own home or from any other location that is convenient for you.

- Unlike paper-based ITRs, which can be misappropriated if they fall into the wrong hands, e-filing ensures that your income information is kept confidential and safe.

- When e-filing your taxes, you can readily view your previous returns, which are securely saved online.

- Once you've e-filed your tax returns for the year, you'll receive a confirmation receipt as well as an email notification to your registered email address.

- Detailed instructions are available to help you in conveniently e-filing your IT return online.

- Not only can the tax be deducted immediately from your bank account, but the refund will also be credited. You can also pay later when you e-file your tax return by ordering your bank to deduct the payable tax from your account via electronic banking.

Now that you've learned a lot about tax filing, it's critical that you make the appropriate investments to save money on taxes.

You can choose between a term plan that provides life insurance and the Canara HSBC Oriental Bank of Commerce Life Insurance's Invest 4G plan, which invests your money while providing financial security in the form of life insurance.

What is ITR-1 OR SAHAJ

This Return Form is for a resident individual whose total income for the AY 2021-22 includes:

- This Return Form is for a resident individual whose total income for the AY 2021-22 includes:

- Salary/ Pension Income; or

- Income from One House Property (excluding cases where loss is carried forward from prior years); or

- Income from Other Sources (excluding Lottery winning and Income from Horse Racings)

- Up to `5000 in agricultural income

Who cannot use ITR 1 Form?

- Total income exceeding ₹ 50 lakh

- Your Total is more than ₹ 50 Lakh

- Agricultural income is more than ₹ 5000

- If you have applicable tax on capital gains

- If you have source of income from any profession or business

- Earn rent from more than one house

- Owning assets (including financial interests in any corporation) outside India) if you are a resident, including signing authority in any account located outside India

- If you are a Director in a firm

- If you have had investments in unlisted equity shares at any time during the financial year

- If you are a non-resident and a resident not ordinarily resident (RNOR),

- Possessing overseas assets or earning foreign income

- If you are liable for tax on the income of another person for which tax is deducted in the other person's hands.

What is ITR-2

ITR 2 is for an individual or a Hindu Undivided Family (HUF) whose total income for the financial year 2021-22 includes the following items:

- Income from Salary or Pension; or

- Income from House rent; or

- Income from Other Sources (including income from Race Horses and from Lottery Winnings).

- (You total income from the above mentioned must be more than ₹ 50 Lakhs)

- If you are a company's Individual Director

- Being a resident not ordinarily resident (RNOR) and non-resident at any period during the financial year

- Having investments in unlisted equity shares

- Gains from capital investments; or

- Foreign Income/Foreign Assets

- Income from agriculture of more than ₹ 5,000

Who is not permitted to use this Return Form?

An individual whose total income for the Assessment Year 2021-22 includes earnings from a business or profession should not use this Return Form.

You may need to file ITR-3 or ITR-4 to declare these sources of income. To learn how to fill out the ITR-2 form, see our detailed instructions.

What is ITR-3

Individuals or Hindu Undivided Families that have income from a proprietary business or profession should use the current ITR3 Form.

ITR 3 is available to anyone who generate income from the following sources:

- Running a business or practising a vocation.

- If you are a company's Individual Director.

- If you have unlisted equity stock interests at any period during the fiscal year.

- Income from a house, salary/pension, and income from other sources may all be included in the return.

- A person's income as a partner in the firm.

ITR-4 or Sugam

Individuals, HUFs, Partnership firms (other than LLPs), and Partnership firms (other than LLPs) who are citizens and whose total income includes:

- Business income as defined under section 44AD or 44AE's presumptive income scheme

- Professional income as specified by Section 44ADA's presumptive income scheme

- Salary or pension income of up to ₹ 50 lakh

- Not more than ₹ 50 lakh in income from a single residential property (excluding the amount of brought forward loss or loss to be carried forward)

- Earnings from other sources that do not exceed ₹ 50 lakh (excluding income from race-horses and lottery)

Please note that if your gross earnings are less than ₹ 50 lakhs, you can apply for a presumptive plan if you earn money from the above-mentioned sources as a freelancer.

When an individual or a business prefers to generate its income on a presumptive basis under sections 44AD, 44AE, and 44ADA, the income is supposed at a minimum rate based on a percentage of gross revenues / gross turnover or based on ownership of commercial vehicles.

If the taxpayer's business turnover exceeds ₹ 2 crore, he or she must file an ITR-3.

Who cannot use ITR 4 Form?

- If your total annual income is more than ₹ 50 lakh

- Having money from multiple rental properties

- If you have any carried-forward loss or losses to be carried-forward under any head of income,

- Ownership of any foreign asset

- If you have signing authority over any accounts that are not in India

- Having a source of income other than India

- If you are a firm director,

- If you have unlisted equity stock investments at any period during the financial year.

- Being a non-resident and a resident not ordinarily resident (RNOR)

- Owning overseas assets or earning foreign income

- If you are liable to be taxed on the income of another person for which tax is deducted in the other person's hands.

What is ITR-5

- Firms,

- LLPs (Limited Liability Partnerships),

- AOPs (Association of Persons),

- BOIs (Body of Individuals),

- Artificial Juridical Person (AJP),

- Estate of an Insolvent Person,

- Estate of a Deceased Person,

- Business Trust, and

- Investment Fund is all covered by ITR 5.

What is ITR-6

This report must be filed electronically only for corporations that do not claim tax exemption under section 11 (Income from property managed for charity or religious purposes).

What is ITR-7

For individuals, including businesses, who are required to file returns under section 139(4A), section 139(4B), section 139(4C), section 139(4D), section 139(4E), or section 139(4F) (4F).

- Every person who receives income from property held under trust or other legal obligation entirely or partially for charity or religious purposes is required to file a return under section 139(4A).

- A political party must file a return under section 139(4B) if its total income, before applying the provisions of section 139A, exceeds the maximum amount not subject to income tax.

- Every Person is obliged to file a return under section 139(4C).

- Association for Scientific Research;

- A news organisation;

- Section 10(23A) - referenced organisation or institution;

- The institution listed in section 10(23B);

- Any hospital or other medical institution, as well as any fund or institution, university, or other educational institution.

- Every university, college, or other institution that is not required to file a return of profit or loss under any other provision of this section must file a return under section 139(4D).

- Every business trust that is not required to file a return of income or loss under any other provision of this section must file a return under section 139(4E).

- Any investment fund referred to in section 115UB shall file a return under section 139(4F). Any other requirements of this section do not require the filing of a return of income or loss.

Income under Different Heads

Income Heads | Kinds of Income |

Income from Salary | Salary paid, wages earned, pension, annuity, gratuity, Contribution made for Employee Provident Fund (EPF) and EPS, transferred all balance and annual accretions into an EPFO-(Employees’ PF Organization) are calculated. Income from Salary |

Income from Other Sources | Income from interest and dividend earning from fixed deposits, securities, mutual funds, income earned from royalty, from the lottery, horse race winnings, and gifts received from anyone. |

Capital Gains | Long-term and Short-term Capital Gains, Income from sale or transfer of capital assets – Mutual Funds, house property, shares, and stocks. It also includes Long-term and Short-term Capital Losses, both of which are deducted from Capital Gains. |

Income from Business/Profession | Businesses profits or losses including salary, bonuses, or interest paid to a partner in a company. |

Income from House Property | Earned rent on properties owned or acquired by the taxpayer but not occupied by him or her. If no actual rent is received on such a property, the notional rent is taken into account. |

Frequently Asked Questions (FAQ)

Is it mandatory to submit an ITR?

According to income tax guidelines, if you earn more than the amount that is free from taxation by the government, you must file a tax return according to the tax slabs for each year.

Filing your ITR after the deadline may result in a penalty and may make it more difficult to receive a loan or visa in the future.

Who is entitled to file an ITR?

Now that you know what an income tax return is, let's look at the people and businesses who are required by law to file it. This includes the following:

- Anyone under the age of 59 with an annual income of more than ₹ 2.5 lakhs. The exemption amount for senior citizens aged 60 to 79 is ₹ 3 lakhs, whereas the exemption limit for super senior citizens aged 80 and above is ₹ 5 lakhs. Section 10 of the Income Tax Act specifies that income shall be computed without deductions.

- A company making yearly income, even if it has not produced any profit during the year

- A person who wishes to receive a refund for excess income tax or tax deducted from their annual income.

- A person with a property or other financial interest outside of the country.

- A firm based outside of India that enjoys treaty benefits on domestic transactions.

- Non-resident Indians (NRIs) who earn more than the standard yearly exemption limit of ₹ 2.5 lakh.